100% FDI for Insurance Intermediaries: FDI Insurance Reforms

Introduction to FDI Insurance Reforms

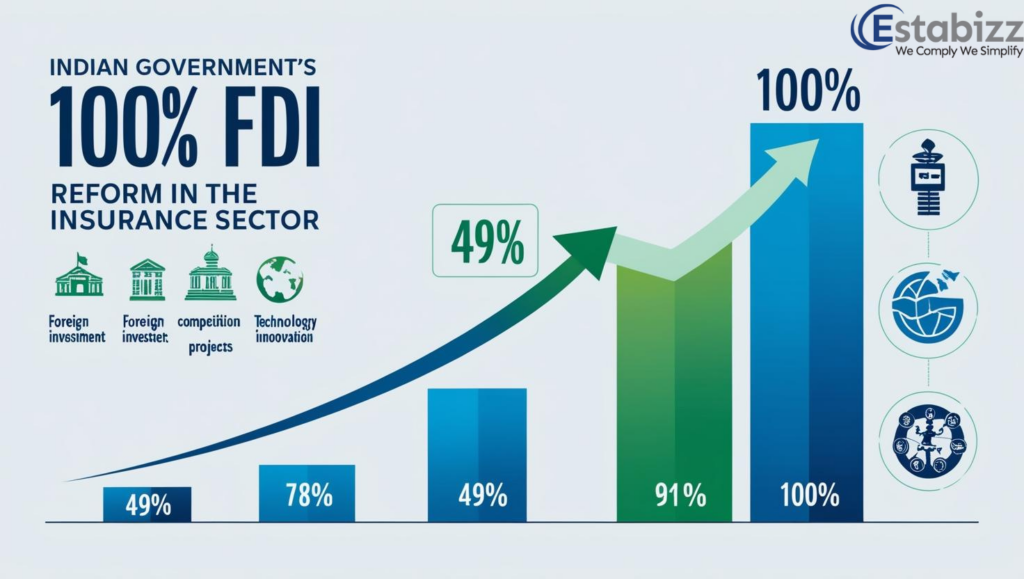

The Indian government’s recent move to increase the foreign direct investment (FDI) cap in the FDI for Insurance Intermediaries sector from 49% to 100% is a landmark reform that promises to reshape the country’s insurance landscape. This reform aims to attract greater foreign investment, foster competition, and introduce global best practices into the Indian insurance industry.

The significance of this reform cannot be overstated. For years, the insurance sector in India has been grappling with challenges such as undercapitalization, limited product offerings, and a lack of technological innovation. By opening the doors to foreign insurers, the government hopes to infuse fresh capital, expertise, and advanced technologies into the sector, ultimately benefiting Indian consumers through improved services, competitive pricing, and a wider range of insurance products.

The impact of this reform is expected to be far-reaching. Foreign insurers with deep pockets and extensive global experience can now establish wholly-owned subsidiaries in India, offering them greater control and flexibility in their operations. This move is anticipated to spur mergers and acquisitions, as well as strategic partnerships between domestic and international players, leading to a more consolidated and efficient insurance market.

Moreover, the increased foreign investment is likely to catalyze innovation in the insurance sector. Global insurers are known for their cutting-edge technologies, such as advanced data analytics, digital platforms, and innovative product offerings. By introducing these technologies and practices to the Indian market, consumers can expect a more seamless and personalized insurance experience, aligning with the evolving digital landscape.

FDI for Insurance Intermediary

Raising the FDI Cap in Insurance

The Indian government has raised the Foreign Direct Investment (FDI) cap in the FDI for Insurance Intermediaries sector from 49% to 100%, allowing foreign companies to own and control insurance companies operating in India. This landmark decision aims to attract more foreign investment, enhance competition, and introduce advanced technologies and best practices to the Indian insurance industry.

The rationale behind increasing the FDI cap is multifold. Firstly, it addresses the long-standing demand from global insurance giants to have greater control and ownership in their Indian operations. Secondly, it aims to bridge the insurance protection gap in India, where a significant portion of the population remains underinsured or uninsured. By attracting more foreign players and capital, the government hopes to increase insurance penetration and provide better access to insurance products across the country.

Furthermore, the move is expected to facilitate the transfer of advanced risk management practices, product innovation, and technological advancements from foreign insurers to the Indian market. This could lead to the development of tailored insurance solutions, improved customer service, and enhanced operational efficiency within the industry.

Potential benefits of the increased FDI cap include:

-

Increased capital inflow: Foreign insurers can now infuse more capital into their Indian subsidiaries, strengthening their financial position and enabling them to expand their operations and product offerings.

-

Enhanced competition: The entry of new foreign players and the potential for existing foreign partners to increase their stakes could intensify competition in the Indian insurance market, benefiting consumers through better pricing, product variety, and service quality.

-

Access to global expertise: Foreign insurers bring with them global best practices, advanced risk management techniques, and cutting-edge technologies, which can help modernize and enhance the Indian insurance industry.

-

Employment generation: The influx of foreign investment and the expansion of insurance operations could create new job opportunities in various sectors, including sales, underwriting, claims processing, and customer service.

Overall, the raising of the FDI cap in the insurance sector is a significant reform aimed at attracting foreign investment, fostering innovation, and ultimately providing better insurance coverage and services to the Indian population.

FDI for Insurance Intermediary

Composite Licensing for Insurance Companies

Composite licensing, a pivotal aspect of the insurance reforms, allows insurance companies to offer both life and non-life insurance products under a single umbrella. This move aims to streamline operations, enhance efficiency, and provide a seamless experience for customers.

Previously, insurance companies were required to obtain separate licenses for life and non-life insurance businesses, leading to operational silos and potential inefficiencies. With composite licensing, insurers can now leverage their expertise and resources across both domains, enabling them to provide comprehensive insurance solutions to their customers.

The advantages of composite licensing are manifold. Firstly, it promotes operational synergies, as insurers can consolidate their back-office functions, such as underwriting, claims processing, and customer service. This streamlining can lead to cost savings and improved operational efficiencies, ultimately benefiting consumers through competitive pricing and enhanced service quality.

Secondly, composite licensing allows insurers to cross-sell and bundle their products more effectively. Customers can now conveniently access a wide range of insurance products from a single provider, simplifying the process of securing comprehensive coverage for their diverse needs.

Furthermore, composite licensing encourages innovation and product diversification within the insurance industry. Insurers can leverage their collective expertise and data insights to develop innovative products that cater to evolving customer demands, fostering a more vibrant and competitive market.

However, the implementation of composite licensing also presents challenges. Insurers need to ensure robust risk management practices and maintain adequate capital buffers to support their expanded product offerings. Additionally, they must navigate the complexities of integrating disparate systems, processes, and corporate cultures, which may have been siloed under the previous licensing regime.

Regulatory oversight and consumer protection measures will also play a crucial role in ensuring fair practices and maintaining trust in the insurance industry. Authorities must establish clear guidelines and monitoring mechanisms to prevent potential conflicts of interest, ensure transparency, and safeguard consumer interests.

Overall, composite licensing represents a significant step towards modernizing the insurance sector in India, fostering greater efficiency, innovation, and customer-centricity. While challenges exist, the potential benefits of streamlined operations, comprehensive product offerings, and increased competition are poised to drive growth and enhance the overall insurance experience for consumers.

FDI for Insurance Intermediary

Attracting Global Insurance Giants

The recent reforms in the insurance sector, particularly the increase in the foreign direct investment (FDI) cap to 100%, are aimed at attracting global insurance giants to the Indian market. By allowing foreign insurers to hold a majority stake in domestic insurance companies, the Indian government hopes to unlock significant investments and bring in advanced technologies, expertise, and best practices from international players.

This move is expected to make the Indian insurance market more appealing to foreign insurers, who have long sought greater control and ownership in their Indian ventures. Companies like AXA, Prudential, and Allianz, which have existing joint ventures in India, may now consider increasing their stakes or establishing wholly-owned subsidiaries, giving them greater control over their operations and strategic decisions.

The influx of global insurance giants could potentially lead to increased competition, product innovation, and better services for Indian consumers. These companies bring with them years of experience, robust risk management practices, and cutting-edge technologies that could revolutionize the Indian insurance landscape. Additionally, their presence could spur domestic insurers to enhance their offerings and operational efficiency to remain competitive.

Moreover, the reforms aim to attract fresh investments from global insurers, which could provide a much-needed capital boost to the Indian insurance sector. This influx of capital could fuel expansion, product development, and technological advancements, ultimately benefiting policyholders and the overall economy.

However, it is crucial for the Indian government to ensure a level playing field and robust regulatory oversight to protect the interests of domestic insurers and prevent any potential monopolistic practices. Striking the right balance between fostering competition and safeguarding the interests of Indian stakeholders will be a key challenge as the market opens up to global players.

Regulatory Oversight and Challenges

The Reserve Bank of India (RBI) and the Insurance Regulatory and Development Authority of India (IRDAI) will play crucial roles in overseeing the implementation of these reforms and ensuring a smooth transition. The RBI, as the central banking institution, will monitor the inflow of foreign direct investment (FDI) and ensure compliance with regulatory norms and guidelines. Additionally, the RBI will oversee the operations of foreign insurers entering the Indian market, ensuring they adhere to prudential norms and maintain financial stability.

On the other hand, the IRDAI, as the dedicated regulator for the insurance sector, will be responsible for granting composite licenses to insurance companies and overseeing their operations. The IRDAI will need to establish a robust framework for composite licensing, ensuring that insurers meet the necessary capital requirements, governance standards, and operational guidelines.

One of the significant challenges for the regulatory bodies will be striking a balance between promoting growth and ensuring consumer protection. With the entry of global insurance giants and the potential for increased competition, regulators will need to closely monitor market practices, prevent predatory pricing, and safeguard the interests of policyholders.

Furthermore, the implementation of composite licensing may pose operational challenges for existing insurers. Transitioning to a composite model may require restructuring, integrating systems, and developing new product offerings. Regulators will need to provide clear guidelines and facilitate a smooth transition process to minimize disruptions in the industry.

Effective coordination and collaboration between the RBI and IRDAI will be crucial in addressing regulatory challenges. Regular communication, data sharing, and harmonization of policies will be essential to ensure consistent oversight and avoid regulatory arbitrage.

Impact on Consumers

The FDI insurance reforms are expected to have a significant impact on consumers in India. One of the primary benefits is the potential for increased competition in the insurance market. With global insurance giants entering the Indian market, domestic insurers will face heightened competition, which could lead to more innovative and competitively priced products for consumers.

Additionally, the entry of foreign insurers is likely to expand the range of insurance products available to Indian consumers. These companies bring with them expertise in various insurance domains, such as specialized insurance products for niche markets or advanced risk management solutions. Consumers may gain access to a wider array of insurance options tailored to their specific needs.

Furthermore, the increased competition could drive insurers to enhance their customer service and claims settlement processes. Companies may strive to provide more efficient and customer-friendly services to retain and attract policyholders in a highly competitive landscape.

However, it is essential to note that the reforms also carry potential risks for consumers. With the influx of foreign insurers, there may be concerns about transparency, fair business practices, and consumer protection. Regulatory bodies will need to ensure that adequate safeguards are in place to protect consumer interests and prevent any unfair or deceptive practices.

Moreover, the introduction of composite licenses, which allow insurers to offer both life and non-life insurance products, could lead to potential conflicts of interest or cross-selling practices that may not always align with the best interests of consumers. Regulatory oversight and consumer education will be crucial to mitigate such risks.

Overall, while the FDI insurance reforms present opportunities for consumers in terms of increased choice, competitive pricing, and innovative products, it is essential to strike a balance between fostering a competitive market and ensuring robust consumer protection measures.

Growth Prospects for the Insurance Sector

The recent insurance reforms allowing 100% foreign direct investment (FDI) in the sector are expected to drive significant growth and expansion in the Indian insurance market. With the entry of global insurance giants, the sector is poised to witness an influx of capital, technological advancements, and operational expertise.

Projections indicate that the Indian insurance industry could experience a substantial surge in premiums, with estimates suggesting a potential doubling of the market size within the next five to ten years. This growth will be fueled by increased competition, product innovation, and improved distribution channels facilitated by the presence of international players.

Moreover, the expansion of the insurance sector is anticipated to create numerous employment opportunities across various roles, including underwriting, claims management, sales, and customer service. This job creation will not only contribute to the Indian economy but also foster skill development and professional growth within the workforce.

The insurance reforms are also expected to have a ripple effect on ancillary industries, such as actuarial services, risk management, and insurance technology (InsurTech). These allied sectors are likely to witness increased demand, driving further economic growth and attracting investments.

Furthermore, the influx of foreign capital and expertise is projected to enhance the overall efficiency and competitiveness of the Indian insurance industry. This, in turn, could lead to better risk management practices, improved customer service, and the development of innovative products tailored to the unique needs of the Indian market.

Overall, the insurance reforms present a significant opportunity for the sector to thrive, contributing to the country’s economic growth, job creation, and financial inclusion efforts. However, effective implementation, regulatory oversight, and a conducive business environment will be crucial in realizing the full potential of these reforms.

Concerns and Criticisms

While the FDI insurance reforms aim to boost the sector’s growth and attract global players, they have also raised concerns and criticisms from various stakeholders. One major concern is the potential dominance of foreign insurers, which could undermine the interests of domestic companies and policyholders. There are fears that global giants with deep pockets and advanced technology could monopolize the market, leaving little room for Indian insurers to compete effectively.

Another criticism stems from the apprehension that foreign insurers may prioritize profits over customer welfare, leading to unfair practices or inadequate claim settlements. Critics argue that the reforms could compromise the affordability and accessibility of insurance products, particularly for the vast underserved population in rural and semi-urban areas.

Furthermore, there are concerns about data privacy and security as foreign insurers may leverage advanced technologies and data analytics to gain an unfair advantage. Critics warn that without robust data protection laws and regulations, sensitive customer information could be at risk of misuse or exploitation.

Additionally, some stakeholders have raised concerns about the potential job losses and displacement of Indian professionals as foreign insurers bring in their own workforce and practices. There are fears that this could undermine the development of local talent and expertise in the insurance sector.

Lastly, critics argue that the reforms may not necessarily translate into better products or services for consumers if the regulatory framework fails to ensure fair competition, transparency, and accountability. They emphasize the need for stringent oversight and consumer protection measures to mitigate potential risks and safeguard the interests of policyholders.

Preparedness of Indian Insurance Companies

Indian insurance companies face a daunting challenge in preparing for heightened competition from global giants. With the proposed reforms allowing increased foreign direct investment (FDI) and the introduction of composite licenses, the domestic insurance landscape is poised for a significant transformation. Indian insurers must strategize and adapt swiftly to maintain their competitive edge.

One crucial aspect is technological advancement. Global insurers are known for their cutting-edge technologies, data analytics capabilities, and digital platforms. Indian companies must invest heavily in upgrading their technological infrastructure, embracing digitalization, and enhancing their data-driven decision-making processes. This will not only streamline operations but also enable them to offer innovative products and services tailored to evolving customer needs.

Another critical factor is product diversification and customization. With increased competition, Indian insurers must expand their product portfolios beyond traditional offerings. They should explore niche markets, develop specialized products, and cater to specific customer segments. Customization and personalization will be key to retaining existing customers and attracting new ones in a crowded market.

Human capital development is equally important. Indian insurers should focus on upskilling their workforce, providing comprehensive training programs, and attracting top talent. Building a highly skilled and knowledgeable workforce will ensure they can compete effectively with global players in terms of expertise and service quality.

Furthermore, Indian insurance companies should leverage their local market knowledge and established customer relationships. While global insurers may bring advanced technologies and products, Indian companies have a deep understanding of the local market dynamics, cultural nuances, and customer preferences. Capitalizing on this advantage and offering localized solutions can help them maintain a competitive edge.

Lastly, strategic partnerships and collaborations could be explored. Indian insurers could consider forming alliances with global players, leveraging their strengths while retaining their local market expertise. Such collaborations could facilitate knowledge transfer, access to new technologies, and expansion into international markets.

In essence, Indian insurance companies must proactively adapt to the changing landscape by embracing technology, diversifying offerings, developing human capital, leveraging local market knowledge, and exploring strategic partnerships. A well-planned and executed strategy will be crucial for their survival and growth in the face of intensified competition from global insurers.

Future Outlook and Recommendations

The recent FDI insurance reforms have opened up a world of opportunities for the Indian insurance sector. As global insurance giants enter the market, the competition is expected to intensify, driving innovation, product diversification, and improved customer service. However, successful implementation of these reforms will require a collaborative effort from all stakeholders, including the government, regulators, and industry players.

Potential future developments could include the introduction of new insurance products tailored to the evolving needs of the Indian population, such as micro-insurance, cyber insurance, and climate-related insurance solutions. Additionally, the adoption of advanced technologies like artificial intelligence, blockchain, and big data analytics could streamline operations, enhance risk assessment, and provide personalized offerings to customers.

To ensure the smooth integration of global insurers and the sustainable growth of the industry, the government and regulators should prioritize the development of a robust regulatory framework. This framework should strike a balance between promoting innovation and maintaining financial stability, while also ensuring consumer protection and fair market practices.

Furthermore, Indian insurance companies should proactively embrace digital transformation, invest in upskilling their workforce, and forge strategic partnerships or collaborations with global insurers to leverage their expertise and best practices. This will enable them to remain competitive and adapt to the changing market dynamics.

In the long run, the FDI insurance reforms have the potential to contribute significantly to the Indian economy by attracting foreign investment, generating employment opportunities, and enhancing financial inclusion. As the insurance penetration levels increase, it will not only provide risk mitigation for individuals and businesses but also facilitate infrastructure development and economic growth.

To fully realize the benefits of these reforms, it is crucial to address challenges such as low insurance awareness, lack of trust in the industry, and inadequate distribution channels, particularly in rural and semi-urban areas. Concerted efforts should be made to improve financial literacy, promote consumer education, and leverage technology to reach underserved segments of the population.

Overall, the FDI insurance reforms have set the stage for a transformative period in the Indian insurance sector. With a forward-looking approach, collaborative efforts, and a commitment to serving the best interests of consumers, the industry can unlock its true potential and contribute significantly to the nation’s economic development.

India allows 100% FDI in insurance, aiming to attract global insurers and strengthen the market. Key changes include composite licenses and higher FDI limits.

Disclaimer:

Estabizz Fintech offers this analysis for informational purposes, gathering insights from authoritative news sources, regulatory announcements, and related media channels. We do not hold responsibility for any decisions made based on this content. We advise consulting relevant regulatory authorities for the most accurate guidance.